Gain on Vesting of Equity Instruments item

SimplePay has a built-in item for amounts received or accrued from the vesting of any equity instrument. The allowance is reported under code 3718 for local services income, and code 3768 for foreign services income.

You should contact SARS to obtain a tax directive, which will provide details about how the Gain on Vesting of Equity Instruments should be taxed.

What is an “equity instrument”?¶

In Section 8C of the Income Tax Act, SARS describes an equity instrument as; * any share or part thereof in the equity share capital of a company or a member’s interest in a company, which is a close corporation * any non-equity share, such as a redeemable preference share * an option to acquire such a share, part of a share or member’s interest; * any other financial instrument that is convertible to a share, part of a share or member’s interest; * any contractual right or obligation the value of which is determined directly or indirectly with reference to a share or member’s interest, for example, a contingent or vested interest in a trust that holds shares.

Why do I need to obtain a tax directive for this payment?¶

A tax directive is simply an official instruction from SARS to your employer or fund manager to deduct tax at a set rate determined by SARS for your individual case and not the general income tax rates. This directive ensures you pay a fair tax rate on your earnings, most notably for larger or irregular payments.

How do I obtain a tax directive, and which one is required for a gain on vesting equity instruments?¶

You can obtain the form via the efiling platform. Currently, the corresponding SARS form is IRP3(s). However, this is subject to change or adjustment by SARS and its processes.

Please refer to the SARS help page for more information on what form to use and how to obtain the directive.

Can I just record the payment as a normal income or irregular income?¶

This is not advised as it is almost certain that the tax will be incorrectly calculated as a standard or irregular income. This will result in an inaccurate declaration of the company and the individual’s PAYE, which would require correction upon assessment.

SARS has introduced the tax directive mechanism to ensure fair tax treatment of once-off payments of this nature.

Using the system item¶

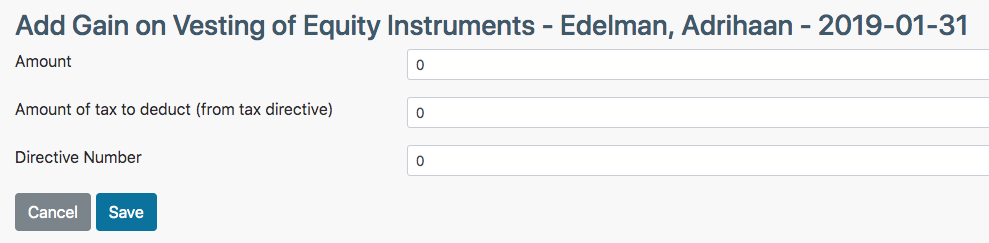

To add the Gain on Vesting of Equity Instruments item:

- Go to Employees and select the relevant employee.

- Click on Add (next to Payslip Inputs).

- Select Gain on Vesting of Equity Instruments under Allowance.

- Enter the following information:

- The Amount

- The Amount of tax to deduct (from tax directive)

- The Directive Number as found on the document obtained from SARS.

- Click Save.