SARS Employment Taxes Validation Process

As of the 2020 tax year, SARS is holding employers more accountable for ensuring that they deduct the correct PAYE and SDL. This is being done through a validation process, whereby SARS performs calculations on the tax certificates submitted by employers. Where SARS has determined that employers are not withholding the correct amount of PAYE, the employer will be responsible for taking corrective action. This includes recovering the amount from employees or facing the penalty of paying it on behalf of employees in cases where the employer under-deducted PAYE.

After a submission for the applicable year of assessment is made, SARS will validate the PAYE and SDL amounts submitted. If any discrepancies are found between SARS’ and the submitted values, a notification and accompanying file are issued to determine whether the correct taxes were declared on the tax certificate.

Although SARS does not reject any certificates during the tax validation process, employers must ensure that taxes are correctly calculated. The SARS website states the following:

Note: The purpose of the Payroll Tax Validation letter is to inform the employer of discrepancies on the amount of tax or levies that were deducted for employees. All the certificates submitted were accepted and processed and will be pre-populated on the employee’s income tax return (ITR12).

Finding the List of Flagged Certificates¶

The list of flagged tax certificates which are issued with the notification can be found on the channel used to submit the tax certificates, namely:

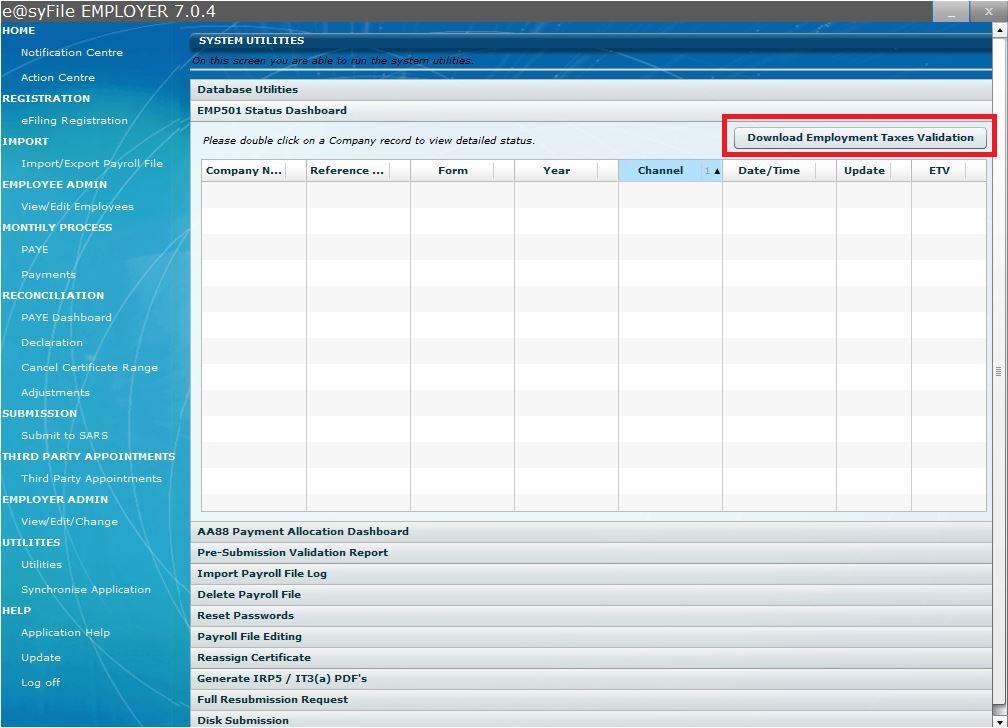

e@syfile¶

The file can be found on the status dashboard:

- Click on Update to see the submission status;

- Click on the Download Employment Taxes Validation button at the top of the screen to download the “tilde (~) delimited file”.

eFiling¶

The file can be found on the EMP501 work page next to the EMP501 information:

- Click on VIEW under the View Certificate Errors heading;

- The “tilde (~) delimited file” can be downloaded or saved (depending on the browser used).

UIF Validation¶

SARS has stated that they will not be validating the UIF contributions, due to the fact that the value for remuneration in calculating UIF is not present on EMP201s and SARS is also not able to apply the monthly limit. This will therefore need to be double checked by employers to ensure they have the correct value.

Process to Follow for Over and Under Deductions¶

The process to follow to correct any over or under deductions can be found on this SARS webpage.

In both cases, it may be necessary to amend the respective certificates. The existing certificate can be amended (i.e maintaining the certificate number), provided that there are no changes to:

- the type of certificate (IRP5 or IT3(a));

- the transaction year; or

- the year of assessment.

If any of the above does need to be amended, the original certificate must be cancelled and replaced with a new one (yielding a new certificate number).

For any amendments to your certificates, please contact us so we can help you to do this on the system. Along with a request, please provide:

- The SARS tilde (~) delimited file (The error report).

- Details of the over/under deduction that has been flagged and the employee(s) which they correspond to.

- The original CSV file from your submission.

- Any additional relevant information that you have, which will be of assistance.