ETI Corrections (Over-Claims and Under-Claims)

This help article provides information on how to deal with situations where you realise that you have made an error with your company-wide ETI settings, or an employee’s ETI setup, which has impacted the ETI that you previously claimed.

As a general principle for ETI, SARS accepts payments from employers throughout the year but wants to minimise refunds. Therefore, over-claims can be corrected in the month in which the error occurred, and the difference should be paid over to SARS, while under-claims in prior months should be set off against current payments due to SARS. This is elaborated on in further detail below.

Over-Claims¶

As mentioned above, if you over-claimed ETI resulting in you underpaying SARS, you will need to make the correction in the month the error occurred. The following steps outline the process for correcting over-claims:

Step 1¶

Correct the settings or setup on the system that caused the ETI calculation to be too high.

Step 2¶

Go to Filing > Monthly Submissions, and note any new EMP201s generated. A new EMP201 will automatically be generated for each period affected by the change in the settings or setup. For example, if you have claimed 6 months of ETI for an employee, and you change the employee’s date of birth on the system, 6 new EMP201s will be generated.

Step 3¶

If the error is discovered only after the EMP501 has been submitted, you will need to navigate to Filing > Bi-Annual Filing (IRP5s etc) to obtain the updated IRP5/IT3(a) and EMP501.

Step 4¶

Resubmit the revised EMP201 and EMP501 information (if applicable) to SARS via e@syFile or eFiling.

Step 5¶

Pay any shortfalls in PAYE over to SARS.

Under-Claims¶

If you under-claimed ETI resulting in you overpaying SARS, the following should be kept in mind:

- Note 1: The shortfall should appear on the EMP201 in the month during which the error was discovered. For example, an error on the June ETI calculation that is discovered in July will be included in July’s EMP201.

- Note 2: The shortfall will appear on the IRP5/IT3(a) for the period that the ETI relates to. For example, an error on the June ETI calculation that is discovered in July will be included in June’s ETI information on the tax certificate.

- Note 3: Shortfalls can be claimed only before the end of the period for bi-annual filing, or they must be forfeited. In other words, underclaims for ETI for March – August cannot be claimed on EMP201s after August, and underclaims for ETI for September – February cannot be claimed on EMP201s after February.

The following steps outline the process for correcting under-claims:

Step 1¶

Correct the settings or setup on the system that caused the ETI calculation to be incorrect.

Step 2¶

Go to Filing > Monthly Submissions, and note any new EMP201s generated. A new EMP201 will automatically be generated for each period affected by the change in the settings or setup. For example, if you have claimed 6 months of ETI for an employee, and you change the employee’s date of birth on the system, 6 new EMP201s will be generated.

Step 3¶

Open the web view of the new EMP201s that were generated and note the ETI under-claim generated. Then, you will need to indicate whether this ETI should be allocated to the EMP201 for the period when the error was made or to a later EMP201, by asking the following questions:

Which period’s EMP201 is impacted by this ETI calculation error? E.g. EMP201 for 1 – 31 May.

Has the submission deadline for this EMP201 passed? If the error on the EMP201 for 1 – 31 May is discovered and corrected on 5 June, then NO, the deadline has NOT passed, since May submissions must be done by the 7th of June. If the error for the same EMP201 was discovered only on 15 June, then YES, the deadline has passed.

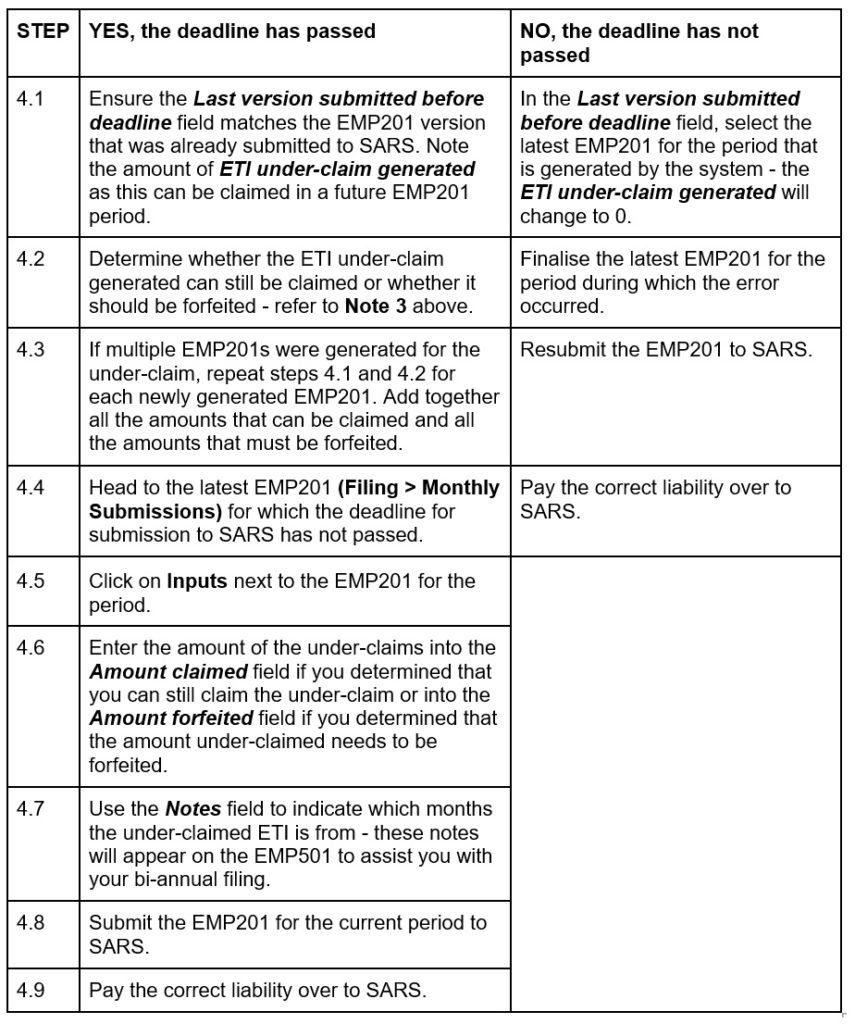

Step 4¶

Complete the remaining steps below based on whether you answered “Yes” or “No” to the deadline having passed.

Note

- You can use under-claims only in current or later periods. If, for example, you under-claimed ETI in March, April, and May, you cannot claim April and May’s ETI on March’s EMP201.

- If you had to forfeit ETI (please see Note 3 above), it is important that you use the Amount forfeited field to ensure that your filing documentation is accurate and complete. You can also add a note to help explain any discrepancies to SARS.

What should I do if I made an error when selecting the Last version submitted before deadline?¶

If you made an error in step 4.1 above and finalised your EMP201s, you can correct this error by clicking on Inputs next to the EMP201 heading when going to Filing > Monthly Submissions. Then, use the dropdown menu for Last version submitted before deadline to select the correct EMP201. A new draft EMP201 may then be generated (if necessary), which will then need to be finalised.