Additional ETI (COVID-19)

Additional ETI is a tax relief measure which has been introduced as part of the government’s response to the effects of the COVID-19 pandemic and later, the civil unrest experienced in some parts of the country in July 2021. In terms of this relief measure, the ETI claimable by employers for qualifying employees is increased for limited specified periods and in certain cases the employee will be allowed to claim ETI for employees who ordinarily would not qualify for ETI due to that employees age, employment date or the employer already having already claimed the allowable 24 months.

Thus far, two periods of Additional ETI have been implemented by SARS, being 1 April to 31 July 2020 and 1 August to 30 November 2021.

These ETI measures are only applicable:

- During the periods specified by National Treasury and SARS.

- For employers who were registered with SARS before cut off dates specified for each period.

- For employees who qualify in terms of the Additional ETI requirements.

ETI Claimable¶

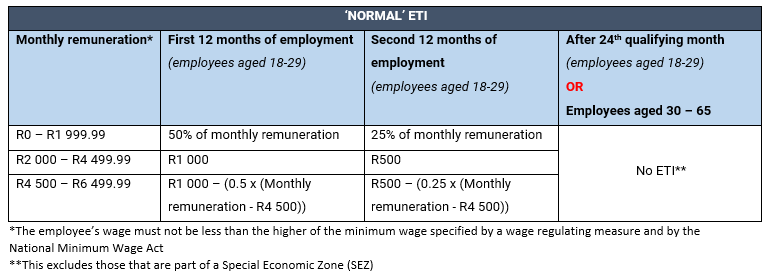

The following table details the amount that can be claimed for ETI per qualifying employee under regular circumstances:

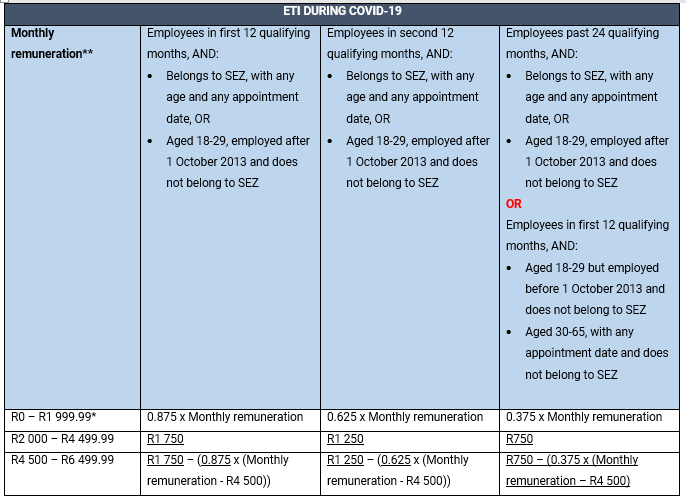

If you are a qualifying employer for the Additional COVID-19 ETI and have enabled this on the system (as outlined below), then the following ETI rules supersede the regular ETI rules:

*The ETI amount changed for this bracket

**In order to qualify for ETI, the employee’s wage must not be less than the higher of the minimum wage (specified in the National Minimum Wage Act) or a wage dictated by a wage regulating measure. This will need to be configured under Settings > Payroll Calculations > ETI

As can be seen from the tables above, ETI was previously only claimable for 24 months. ETI can also be claimed during the periods of Additional ETI relief even if you have already previously reached the ETI 24-month limit for that employee.

Qualifying Employees¶

ETI may only be claimed for qualifying employees. The Additional ETI provisions relax the age criteria so that ETI is claimable for employees aged 18-65. It also relaxes the criteria of the appointment date.

This means that an individual is a qualifying employee for ETI, during the Additional ETI period, if they:

- have a valid South African ID, Asylum Seeker permit or an ID issued in terms of the Refugee Act;

- are 18 to 65 years old;

- were employed by the employer or an associated person to the employer before or after 1 October 2013;

- are paid the higher of the national minimum wage or wage regulating measure applicable to that employer and not more than R6 500;

- are not a domestic worker; and

- are not a connected person to the employer.

All of the above requirements must be met before you are eligible to claim ETI for an employee.

The first four aspects are handled automatically by the system based on how your employees are set up. It is, therefore, crucial to ensure that you have captured their birthdates, appointment dates and ID numbers correctly under their Basic Info section.

Note: employers that are not covered by the National Minimum Wage Act or by a wage regulating measure are not eligible to claim ETI during the Additional ETI periods.

Enabling the Additional ETI Rules¶

Step 1: Enable Additional ETI¶

If you qualify for the additional ETI rules, you will need to indicate this on SimplePay. To do so:

- Go to Settings > Payroll Calculations > Additional ETI (COVID19).

- Select the Additional ETI Effective Date (for the applicable period)

- Click Calculate.

Step 2: Unfinalise payslips****¶

If you have already finalised payslips for the period that you wish to claim ETI for, you will need to unfinalise**** the payslips for this period before continuing onto step 3. If you have not yet finalised your payslips for the period that you wish to claim ETI for, you can skip this step.

****NB! We generally do not recommend unfinalising payslips if you have already paid employees as this can cause significant variances in nett pay if regular items have been changed. Therefore, it is recommended that you take caution when doing this – ensure that you have saved a copy of all payslips, as well as the transaction history report for the period before unfinalising the payslips. You will then need to reconcile your new finalised payslips against the saved payslips used to pay employees.

Step 3: Enable ETI for the employee¶

If you have previously set your employees up on SimplePay for ETI, you can skip this step. If you have never claimed ETI before and now wish to do so, you will need to enable each qualifying employee for ETI (refer to the qualifying criteria above – remember, you will need to use your judgement for criteria 5 and 6 to determine whether the employee qualifies for ETI; the other criteria are determined automatically by SimplePay based on your inputs):

- Go to an employee’s profile

- Click on Edit Info > ETI

- Set their Status to ‘Allow’

- Enter the Effective from date as 1 April, 1 May, 1 June or 1 July, depending on when you will be starting to claim ETI from.

- Click Save

Step 4: Finalise payslips¶

When the additional ETI settings are configured, as well as the ETI settings for qualifying employees, the COVID-19 ETI rules will apply to all payslips from the effective date indicated in step 3 until July 2020 once the payslips are finalised, provided that the employee still meets all the qualifying criteria.

ETI Reimbursements¶

In addition to adjusting the ETI claimable (as outlined above), SARS has also In addition to adjusting the ETI claimable (as outlined above), SARS has also accelerated the payment of ETI reimbursements from twice a year to monthly during periods of Additional ETI, in order to get cash into the hands of compliant employers as soon as possible.

ETI on Tax Certificates¶

The SimplePay system has been updated to incorporate these changes so that the various ETI amounts are reported under the correct SARS codes on the IRP5/IT3(a) during these periods.

———————————————————————————————————————-

For more information on ETI, such as qualifying wages, visit our ETI help page here.