Additional COVID-19 ETI Changes

In a previous blog post, we informed you of additional ETI as a COVID-19 relief measure. The revised Disaster Management Tax Relief bills have given rise to some changes:

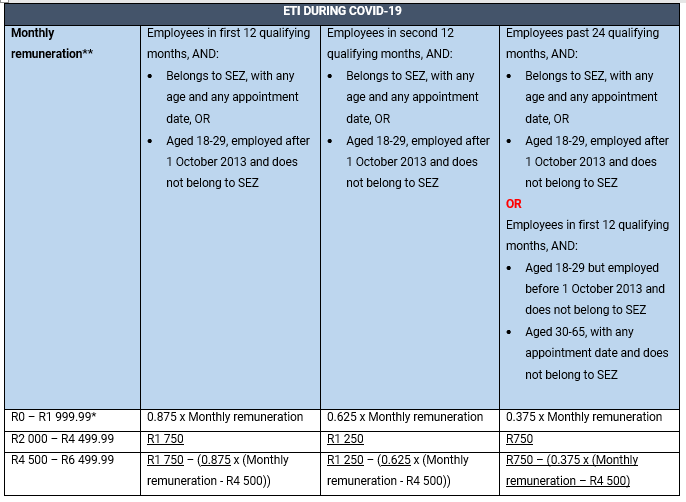

- The ETI claimable for those in the R0 – R1 999.99 bracket has changed, retrospectively effective from 1 April 2020.

- Employees with an appointment date before 1 October 2013 are now eligible for the Additional ETI, retrospectively effective from 1 April 2020.

- As with normal ETI, remuneration should be grossed up and additional ETI for April should be grossed down proportionately if an employee is employed for less than 160 hours per month. This grossing up of remuneration and grossing down of ETI no longer applies, effective 1 May 2020.

SimplePay has implemented these changes to the system and automatically applied it to all payslips for April (even finalised ones). Therefore, all you need to do is:

- Finalise the new EMP201 that is automatically generated by the system

- Submit the new EMP201 information to SARS

Please also note:

- The additional ETI is applicable until 31 July 2020

- To qualify for the additional ETI, the employer must have been registered for PAYE after 25 March 2020

- Employers that are not subject to a wage regulating measure AND that are exempt from the National Minimum Wage Act are not eligible from the additional ETI benefits for May – July 2020.

For more information, head to our help pages:

If you need further assistance, please contact our support team.

Team SimplePay