National Budget Speech 2022

Update: 16 March 2022

The Finance Minister has increased the prescribed rates per kilometer used when calculating travel allowances from R3.82 to R4.18. Our team has updated our system to ensure that the new rate is applied retroactively to payslips from 1 March 2022.

It was further confirmed that the subsistence allowance for expenditure incurred outside of the Republic of South Africa will not be increased for the 2022/2023 year of assessment.

Original Blog Post

On 23 February 2022, the National Treasury presented South Africa’s 2022 Budget Speech, providing individual taxpayers with some much needed relief. Individual taxpayers will be pleased to learn that there will be no significant tax increases to the major revenue-generating categories, such as personal income tax, VAT, and the general fuel levy.

In this blog, we briefly discuss the changes announced in the 2022 Budget Speech and how they affect your payroll.

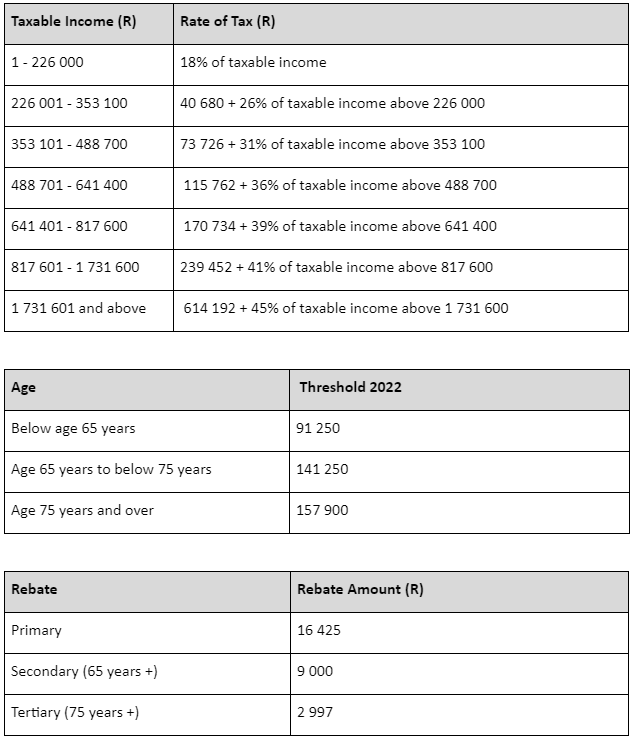

2022 / 2023 Tax Rates and Rebates

In order to adjust for inflation, the personal income tax brackets and rebates will be adjusted by 4.5%. These adjustments will increase the annual tax-free threshold for persons under the age of 65 years from R 87 300 to R 91 250.

Tax Rates from 1 March 2022 - 28 February 2023

Medical Aid Tax Credits

The medical aid tax credits will also increase from 1 March 2022:

- The tax credit for the main member and first dependant will increase from R332 to R347 per month.

- For every additional dependant, the tax credit will increase from R224 to R234 per month.

Subsistence Allowances

Where an employee is entitled to a subsistence allowance, the daily amount in respect of meals and incidental costs will increase from 1 March 2022:

- The allowance granted to pay for incidental costs only will increase from R139 to R152 per day.

- The allowance granted to pay for meals and incidental costs will increase from R452 to R493 per day.

Similarly, SARS periodically adjusts the subsistence allowance for expenditure incurred outside of the Republic of South Africa. At the time of publishing this blog, SARS had not yet updated their website with this information.

Rates per Kilometer

The fixed rates per kilometer which are used when calculating travel allowances is also adjusted periodically by SARS. At the time of publishing this blog, SARS had not yet updated their website with this information.

Should SARS adjust the foreign subsistence allowance or fixed rates per kilometer, we will advise our customers accordingly.

Employment Tax Incentive

It was also announced in the Budget Speech that the Employment Tax Incentive (ETI) will be expanded through a 50% increase in the monthly values - further details will follow in a separate blog that will be published shortly.

We hope that this information has proved useful to you. If you have any questions on how the information provided relates to SimplePay, you can contact us at info@simplepay.co.za.

Related Links:

- 2022 Budget Speech

- Budget Speech Highlights

- SARS Tax Pocket Guide

- SARS Tax Rates

- SARS Subsistence Allowances and Advances

- SARS Rates per Kilometer

Equally, if you are not yet a client of SimplePay but would like to be, why not check out our website? Or, better yet, try out our service for free with our 30-day trial, get acquainted with our user-friendly service by reading our getting started page, or take our free online course.

Keep well and stay safe.

Team SimplePay