Budget Speech 2022: ETI Changes

As discussed in our National Budget Speech 2022 blog, National Treasury recently announced that the monthly values for ETI will be increased by 50% from 1 March 2022.

This blog will explain how this increase affects the calculation of ETI.

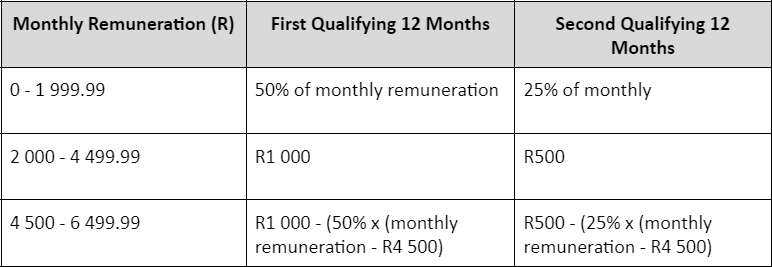

ETI Calculation Formulae prior to 28 February 2022:

Prior to 28 February 2022, ETI was calculated as follows:

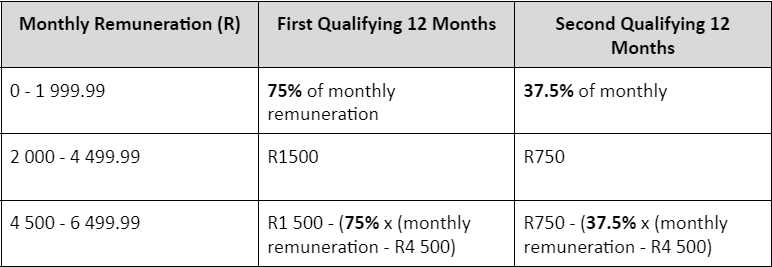

From 1 March 2022, ETI will be calculated as follows:

Our development team has already updated our system to account for these changes. As such, any ETI claimed from 1 March 2022 will automatically apply the new formula.

Please note however, SARS have indicated to us that further changes to the calculation of ETI are forthcoming. We still await final confirmation on a few aspects of these changes. We will implement the required changes as soon as we have received clarity from SARS, which we anticipate in the coming week.

In the meantime, we would request that you hold off on submitting your March EMP201 until we confirm that all changes have been communicated and effected.

For more information on ETI, please refer to our extensive help page section here.

If you have any queries regarding SimplePay or any of our services, please feel free to contact us on support@simplepay.co.za.

Team SimplePay