Updates in SimplePay for the 2018/2019 Tax Year

When you need to do your filing, the correct period will automatically be used and the relevant documents will be generated. For more information, please see our help site.

In addition, our system has already been updated in order to ensure that you are always compliant. We are pleased to inform you that as from 1 March 2018, your payroll will automatically meet all the requirements for the 2018/2019 period, as announced in the 2018 Budget Speech on 21 February 2018. If you are still processing payroll for the 2017/2018 tax year, the old tax tables will still be used, as you’d expect.

Here are some of the most important changes that you will see in your payroll for the coming year:

2018/2019 Tax Rates

As expected, the tax rates and rebates for individuals changed to accommodate inflation.

| Taxable Income (R) | Rate of Tax (R) |

| 0 – 195 850 | 18% of taxable income |

| 195 851 – 305 850 | 35 253 + 26% of taxable income above 195 850 |

| 305 851 – 423 300 | 63 853 + 31% of taxable income above 305 850 |

| 423 301 – 555 600 | 100 263 + 36% of taxable income above 423 300 |

| 555 601 – 708 310 | 147 891 + 39% of taxable income above 555 600 |

| 708 311 – 1 500 000 | 207 448 + 41% of taxable income above 708 310 |

| 1 500 001 and above | 532 041 + 45% of taxable income above 1 500 000 |

The tax threshold has also increased from R75 750 to R78 150 because the primary rebate has increased from R13 635 to R14 067.

Medical Aid Tax Credit

The medical aid tax credit has increased as follows:

- The tax credit for the main member and first dependant has increased from R303.00 to R310.00 per month.

- For every additional dependant, the tax credit has increased from R204.00 to R209.00 per month.

Subsistence Allowance

The ‘tax free’ portion for the subsistence allowance** has increased as follows:

- The allowance for incidental costs within South Africa has changed from R122.00 to R128.00.

- The allowance for meals and incidental costs within South Africa has changed from R397.00 to R416.00.

**It is important to note that the subsistence allowance is only a guideline provided by SARS and is not legislated.

Travel Allowances

- The rate per kilometer for reimbursive travel allowances has increased to 361 cents.

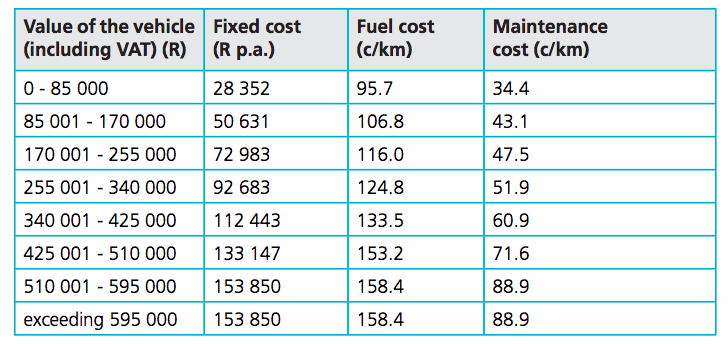

- The rates per kilometre which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed, are outlined in the following SARS table:

If you have any questions relating to the above changes, you are welcome to email us at support@simplepay.co.za to assist you with these queries.

The SimplePay Team